The Power of Perspective

“No problem can be solved from the same level of consciousness that created it.” - Albert Einstein

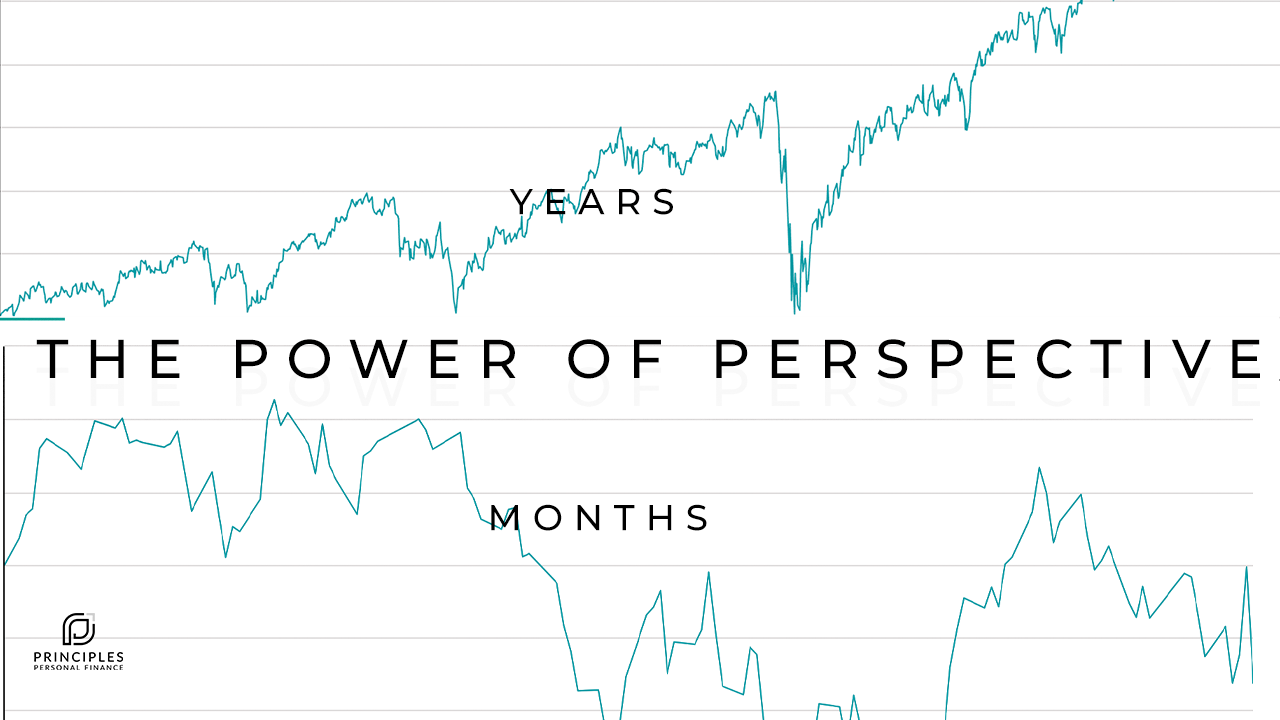

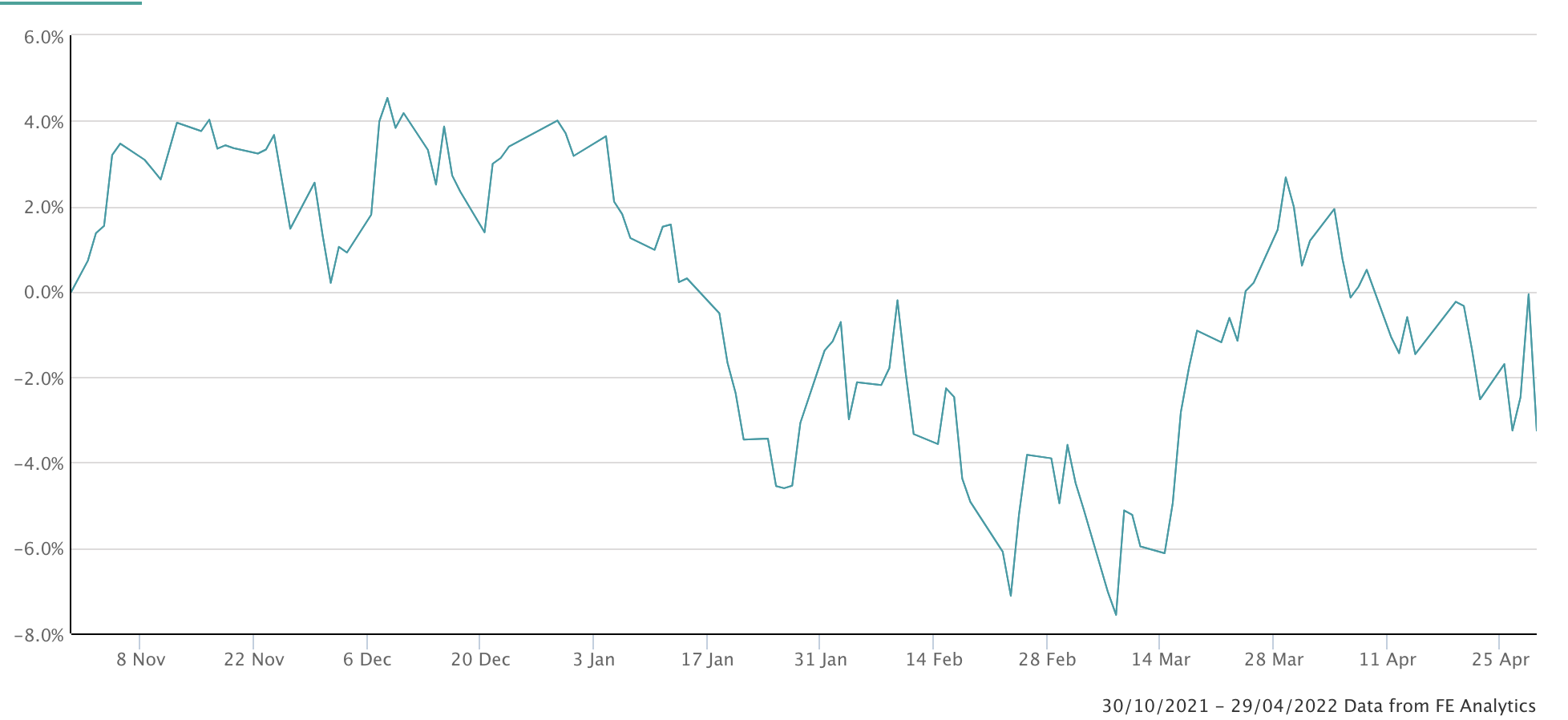

The media is again awash with news of impending doom and gloom in the financial system. Inflation, costs of living, supply chain issues, Brexit, the list goes on. In times like this, the desire to act can sometimes feel overwhelming. The sense that others and the wider market know something you don’t. As we can see below, the last 6 months for the markets have been quite chaotic.

The first thing is to acknowledge that in the history of the markets. This is the norm, not the exception. Credit from the below image to 'The Irrelevant Investor' highlights the extension of JP Morgan’s Guide to the Markets data showing the recent declines in the S&P 500 are around the average historical intra-year decline.

No one knows if market performance is going to get better or worse. Although if there is one prevailing skill for the successful investor it is that of perspective. We can use this to provide context to our decisions. It allows us to zoom out even further and look at the real return from US equities (returns after adjusting for inflation) all the way back to 1849.

The markets are cyclical in their nature but history being our guide, it is worth bearing in mind that any periods of discomfort have been well worth experiencing. With long term after-inflation returns of US equities over the below period being 6.2%. It is only when we adjust our perspective that we can see the true nature of the upward trend. In order or frame these movements we must remember:

1) An investment portfolio is only the fuel for a financial plan

The purpose of any investment is to act as fuel for your own financial plan. Your financial plan is how you align your money to the life you want to lead. It is all too common to buy into narratives of how to adjust your investments to catch the latest economic movements or market trends. In an efficient market, anything that suppresses temporary volatility must at the same time suppress permanent returns. Suppressing temporary volatility is therefore an irrational long-term investment objective. The only logical way to invest is in a manner which aligns with the life you want to lead, not based upon the whims of sentiment, or to avoid this volatility.

2) Discipline and long-term perspective is CRUCIAL to our financial success

There is always a reason to divest but there is no viable strategy to try and time markets. Therefore we have to focus on what we can control. Not allow ourselves to become lost in the malaise of what we cannot. Coming out of the market for anything else apart from short-term spending requires us to have a perfectly timed strategy to get back in, in addition to the issue of trading costs. With market movements being volatile, the very last thing we want to try and do is try our hand as traders.

For those reasons for the well-diversified, investing in real assets has always, in hindsight, been buying opportunity. Although at the time, it will likely have felt equally painful as this may now.

3) The media is not your friend

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.” - Howard Marks

It is almost countercultural to not religiously follow current events. Our phones becoming more extensions of our limbs than tools we use to communicate. The problem is when you accept the constant bombardment of negative events it may lead you to risk your financial future and your long-term plan.

In times like this, we must remember who we want our decisions to serve. We must stay true to our financial future based on the logic that all previous periods of discomfort have been followed by an unrelenting forward march. That the well-diversified equity investor is only investing in real companies that buy and sell things to real people every day. In times of volatility, being able to control your perspective is a skill, a virtue, but most importantly, a choice.